A Perspective on Indian Flavor market

India has a population of 1.21 billion growing at 1.41% per annum; it is a young country with almost 65 % population below the age of 30 years. It has been a traditional country so far but now things are just about to change in a hurry. By the CY 2020 the average age of an Indian is going to be 28 years when compared to 48 years in Japan. The food processing industry in India is one of the largest in terms of production, consumption, import and is in the process of taking off as the average housewife is faced with less time to prepare home made meals as has been traditionally managed. Buoyed by a favorable government policy for the food industry and a demand by a young consuming class with growing disposable incomes, India offers significant investment opportunities in the food, flavor and agro processing sector.

By CY 2015, the Indian food industry is expected to reach USD 258 billion from the current level of USD 181 billion. This growth is expected to continue until FY 2020, where the industry size is expected to touch USD 318 billion. India is making an important mark on the global food industry; both as a large producer and exporter of agriculture products as well as an importer of processed foods. The annual spending of USD 181 billion on food accounts which attributes to 31% of the per capita income is twice as high as any other category including housing.

Innovative Variants Expected to Drive the Indian Food Flavors Market

The Indian food flavors market is set to grow; and offer innumerable opportunities for new entrants to grow in this market. Rampant urbanization, growth of disposable income, availability of convenience goods coupled with growing health concerns are the major drivers for the industry’s growth. Additional factors such as awareness among governments and consumers to address specific health and nutritional needs are strongly fuelling the food and beverage markets, which, in turn are boosting the s market. There is demand for new variants especially in the health foods and beverage categories that keeps the market growing; a trend which is expected to continue for the next few years. The future of the Indian flavors market rests on the launch of novel foods and beverages constituting health and functional ingredients. Innovation in flavor variants of key producers, enhancement of sales force capabilities and technological improvement are the critical factors for the success of a flavor industry.

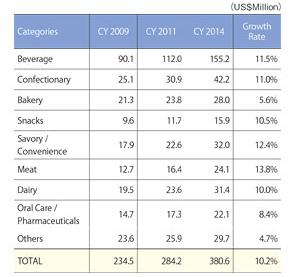

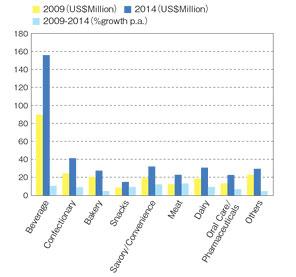

The Indian flavor market is valued at $ 284.2 million in CY 2011 and is expected to grow to $ 380.6 million in CY 2014 at a healthy growth rate of 10.2% which is growing fast ahead at 10% per annum. For details see Table 1 and Chart 1. About 70% of the Indian population resides in the rural areas. The Indian farmer works all year round to harvest three crops thereby ensuring fresh supply of fruit and vegetables. The growth rate for agricultural produce is pegged at CAGR of 3 to 5% and is monsoon dependent. Having said so, only 30% of the Indian milk production is processed and barely 10% of the freshly produce vegetables/ fruits are processed; thereby offering growth prospects to the processed industry.

Data from non governmental organizations reveal that 40% of children are undernourished. Increased effort to change has been initiated by the Government mid-day meal for school going children. The program run by “Akshaya Patra” facilitating hunger free education for nearly 1.3 million children in India through a Mid-day meal scheme is well documented.

The McKinsey Report on Indian Agriculture states that the India food and is extremely fragmented and distribution networks are under developed due to which around 65% population has limited access to flavor containing products.

Future Potential of the Indian Food Sector

The growth forecast of food industry in the future is positive and expected to be 8 to 10% CAGR between 2015 and 2020. This analysis is based on socio-economic and demographic landscape of the country. The key contributors to this shift are expected to be the following:

Socio-economic changes:

- The transition of India’s population across income classes; from lower to higher income classes

- Efforts of the Govt. through the Food Bill to supplement the income of families below the Poverty Level and improve their resources

- A appreciable rise in the lower-middle and middle income household consumption pattern

- A growing young population which demands options.

- The increasing migration of population from rural to urban cities.

Lifestyle changes:

- The emergence of nuclear families; the increase of both partners working to supplement family income

- Rising incidence of lifestyle diseases; viz. diabetes and obesity

- Change in consumer palate due to growing awareness and availability of options.

- Indians are travelling overseas more and adapting to different palates and cultures.

Strategies to increase market penetration and product development of malted health and energy drinks are recommended to enhance growth in that segment. manufacturers are continuously expected to invest progressively in R&D to develop new ings to meet the rapidly changing needs of food and beverage industries. Technological improvement is another critical factor for the success of a ing company. New technologies that improve the application of ings along with new product development are the key factors to maintain a competitive edge over the other market participants as the competition is high. Indian manufacturers need to focus on the pricing of their products and innovation to remain a step ahead of market trends. They are expected to formulate more non-traditional, non seasonal s that are also compatible with the Indian palate. The future market is expected to look Chart 2. Chart 2 Despite brighter growth prospects even during the economic downturn, the Indian market is still struggling for a greater market share in the global foods industry. One of the key challenges it faces is the effect of income distribution; the low-income strata is still unable to afford premium food products that use premium food additives. India is developing country with low per capita calorie intake of 2300 Kcal/person/day. However, the usage of novel s is high in the health foods and beverages segment, which is considered a premium product segment; for which India holds a substantial proportion of target consumers. Since premium ingredients are used in manufacturing of such products, they are priced quite high making it unaffordable by the low-strata income. Due to the health awareness and the growing concern amongst the consumer, the consumption of cola drinks has seen a dip but it is still the largest off-shelf product. Companies have responded to this concern and have launched non-carbonated juice drinks emphasizing on their health benefits. Large Indian multi-nationals (LTA’s) in the food sector viz. Amul, Britannia, ITC, Parle, MTR, Haldiram, Bhikaji and Dabur compete head-on with Nestle, Nissin, Danone and Kraft and have a significant market share in most food categories. Instant Noodles and processed foods have shown a substantial growth rate and are the fastest growing convenient food in India. Gradual growth is observed in dairy sector with number of new launches in the segment especially with ed yoghurts. In the Bakery segment the trends are becoming more focused on health benefits and several new launches were observed in recent months. In totality, the foods segments are opening up and a wider opportunity rests at the epicenter for foods and flavor industry.

2. Indian Fragrance Market

India overwhelms senses in so many ways, India has a different pace of life, crowds of people visible everywhere, rush of sounds, richness of colors and smells. Though different part of country will have its own distinctive fragrances but broadly the smell of India can be described as the morning frangipani fragrant from the local temple to the sweet aroma of chai blended with spices overwhelmed by the smell dust, sweat and burning cow dung transcending to captivating smell of wet earth and nature during monsoon to lingering smell of jasmine and sandal incense.

Early History

The use of fragrance in India dates back to 2600BC during the Indus valley civilization. The earliest scents known to Indians were the healing scents introduced through Ayurveda. According to Ayurveda, the key aim of all fragrances was to purify from negative influences and enhance the spirit. The earliest reference of distillation of Attar (Perfume) was mentioned in the Hindu Ayurvedic text the Harshacharita, written in 7th century A.D. in Northern India mentions use of fragrant agarwood oil. Ayurvedic remedies recommending the use of aromatic herbs and fragrant plants for well-being, hygiene, treatment of ailments, beauty and age-control is well known even today.

Culture and Tradition

Irrespective of diversity in culture the use of fragrance and odoriferous substances has been a common practice across India for different religious functions, festivities and daily rituals. For example the flames meant for religious functions send out sweet scents of herbs. Temple idols are often rubbed with perfumed oil until they gleam. Sandal skin paste applied on forehead and other parts of the body during prayers, worship and meditation. The brides are applied with fragrant ointments to provide glowing skin. Newly weds sit beneath a silk fragranced canopy. The scent of patchouli was used to scent Indian shawls to deliver warm aroma and also act as moth repellant.

Preference Drivers in India

Unparallel cultural diversity of over 200 ethnic groups speaking over 1000 dialects differentiates the fragrance preferences of the consumers across India. Adding to the complexity is the different climatic conditions across India and the constant influx foreign influences over various periods of history. In modern times it is electronic media and faster means of travel gives the young Indians the easy access to latest trends globally.

A strong Mughal (Islamic) influence is visible across North India in food, clothing, as well as olfactive preferences and also due to the colder climatic conditions, Rose is the most preferred fragrance profile for skincare and soaps in the North. The South India being an efficacy driven market has strong affinity for natural aromas. Due this reason Jasmine, Herbal and Sandal are the preferred profiles for hair care, soaps and talc in the South. However the young and urban Indians abreast with latest global trends prefer to flaunt the modern and fashionable image wear the international best-selling perfumes.

Current and Future Business Scenario

Indian fragrance market size is roughly USD 225 million which has been growing at CAGR of 10% since last five years. Soaps and Fabric wash together with 56% market share are the two largest categories in the Indian Fragrance market and deodorants is the fastest growing segment with CAGR of 40%.

Indian fragrance industry has a promising future with the Indian FMCG market expected to grow at 12-15% for next 5 years and also with the rise disposable income, the per capita consumption of various personal care products is expected to grow significantly. For comparison the per capita consumption of skin products in India is USD 0.8 whereas in China and Indonesia it is USD 8.0 and USD 4.3 respectively. Similarly for shampoo the per capita consumption in India is USD 0.6 whereas in China and Indonesia it is USD 2.3 and 2.1 respectively.

India though is land of confluence of many cultures; it is unique and will not allow a trend to be superimposed on it without being Indianized and have reverence to the local cultures and values.

3. Indian Mint Oil and Menthol Industry

Strategic Significance of Indian Agriculture

Although agriculture contributes only 21% of India’s GDP, its importance in the country’s economic, social, and political fabric goes well beyond this indicator. The rural areas are still home to some 72 percent of the India’s 1.2 billion people, a large number of whom are poor. Most of the rural poor depend on rain-fed agriculture and fragile forests for their livelihoods. The sharp rise in food grain production during India’s Green Revolution of the 1970s enabled the country to achieve self-sufficiency in food grains and stave off the threat of repeated famine. Agricultural intensification in the 1970s to 1980s saw an increased demand for rural labor that raised rural wages and, together with declining food prices, reduced rural poverty. Indian agriculture is blessed with arable land area as large as the European Union.

The Indian famer can normally harvest 3 crops a year along the Ganges and Indus basin. Mint is a typical 3rd crop which is planted in January – February and harvested in May-June before the onset of monsoon. Mints belong to the genus Mentha, in the family Labiatae (Lamiaceae) which includes other commonly grown essential oil-yielding plants such as basil, sage, rosemary, marjoram, lavender, pennyroyal and thyme. Within the genus Mentha there are several commercially grown species, varying in their major chemical content, aroma and end use. Their oils and derived aroma compounds are traded world-wide.

India Mint Oil Production

- At present, the major producers of mint oil in the world are India (80%), China (5%), Brazil (1.5%), and the USA (13.5%). The USA grows about 2,800 MT of Mentha piperita and 2,600 MT of Mentha spicata . China grows about 200 MT of Mentha piperita and 500 MT of Mentha spicata.

- About 32,000 MT of Mentha arvensis oil is produced in India from about 0.29 million hectares of land with an average productivity of about 110 kg per hectare during Season 2011. India is the largest producer and exporter of arvensis. Mentha arvensis is cultivated in the sandy-loom soils and the semi-temperate regions of the Himalayan hills along the Ganges as well as the Indus basin in Northern India.

- India cultivates about 4 species of Mentha; out of which three species are exported. In Season 2011, India produced 470 MT of Mentha piperita and 210 MT of Mentha spicata; which has been mostly used in local production or exported to US markets as oil extenders.

- The Indian industry is expected to produce 20,000 MT of Natural Menthol Crystals; about 9,000 MT of Terpeneless De-Mentholated Oil and 3,000 MT of derivatives.

- Support from Government of India for the development of agro-processing industry. Exporter / manufacturers receive 7.5% rebate on their export value.

- The advent of whole arvensis as a tradable commodity on the MCX Futures Commodity Exchange has provided a platform for the Indian farmer and trading community to hedge and realize a better price for their produce.

Global Menthol Scene

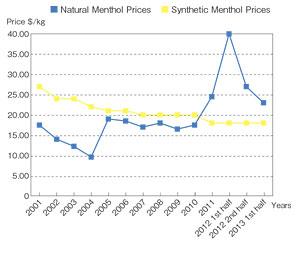

The current price of natural menthol crystal is in the region of $ 38.0 to 40.0/kg; which is about 30% higher than prices for the commodity last February (Chart 1). It is expected that the prices of menthol may go even higher as the stock of whole arvensis with processors is low. The stock position of 4 out of the top 5 menthol processors from India is low and they have difficulty committing to deliveries beyond March 2012. Recent Spot Price movement on the MCX Futures Commodity Exchange and market sentiment suggest that the prices of whole Arvensis is likely to increase to $ 37 to 40.0/kg. The advent of Synthetic Menthol in large quantities from German manufacturers is likely to change the global prices of natural menthol as the supply will outstrip demand by the year 2013-14.

India is a major exporter of exporter of Terpeneless De-Mentholated oils (TRO/DMO) and Indian Peppermint oil. The approximate volume of these commodities is about 8,000 and 1,500 MT per annum, respectively. The change in the prices of Natural menthol in the future is likely to adversely affect and increase the prices of these extenders significantly.

Raji Ghogale (2012) Takasago International (India) Pvt., Ltd.